Indian Railways has demonstrated remarkable financial resilience, with freight revenue surging by ₹54,805 Cr and passenger revenue growing by ₹20,024 Cr between 2019-20 and 2023-24. Despite COVID-19 disruptions, the sector rebounded strongly, leveraging modernisation and strategic fare schemes. This blog breaks down revenue trends, COVID impacts, and the rising role of AC coaches.

Table of contents

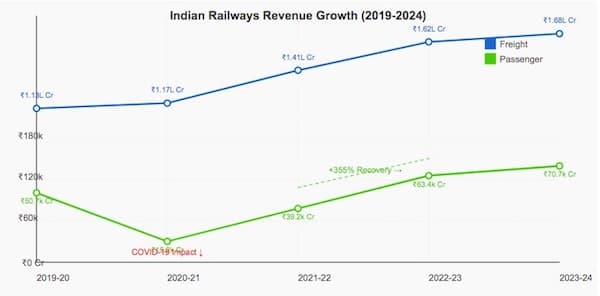

📊 Revenue Trends: Freight vs. Passenger Earnings (2019-2024)

Freight Revenue Growth

Freight operations remained robust, growing from ₹1.13 lakh Cr (2019-20) to ₹1.68 lakh Cr (2023-24). Essential goods transportation ensured stability even during COVID-19.

Passenger Revenue Recovery

Passenger revenue rebounded from ₹15,248 Cr (2020-21) to ₹70,693 Cr (2023-24) post-pandemic, showcasing a strong recovery.

Revenue Table (₹ in Crore)

| Financial Year | Freight Revenue | Passenger Revenue |

|---|---|---|

| 2019-20 | 1,13,488 | 50,669 |

| 2020-21* | 1,17,232 | 15,248 |

| 2021-22* | 1,41,096 | 39,214 |

| 2022-23 | 1,62,263 | 63,417 |

| 2023-24 | 1,68,293 | 70,693 |

Note: *COVID-19 impacted 2020-21 and 2021-22 passenger revenue.

📈 Revenue Growth Chart

Freight vs Passenger Revenue Growth (2019-2024) Freight revenue (blue) shows steady growth, while passenger revenue (green) rebounds post-COVID.

🚉 COVID-19 Impact on Indian Railways

Key Observations

- Passenger Revenue Drop: Plummeted by ₹35,421 Cr in 2020-21 vs. 2019-20.

- Freight Resilience: Minimal dip due to uninterrupted goods transport.

- Post-COVID Recovery: Passenger revenue surged by 355% from 2020-21 to 2023-24.

Coach Distribution (2024)

| Class | Coaches | Seats | % of Total Coaches |

|---|---|---|---|

| General/Non-AC | 56,000 | 51 lakhs | 70% |

| AC Coaches | 23,000 | 14 lakhs | 30% |

| Total | 79,000 | 65 lakhs | 100% |

Revenue Contribution (2019-24)

| Class | Avg. Seat Share | Avg. Revenue Share |

|---|---|---|

| Non-AC | 82% | 53% |

| AC Coaches | 18% | 47% |

Insight: While non-AC coaches account for the majority of seats (82%), AC coaches contribute nearly half (47%) of the total passenger revenue, highlighting the higher ticket fares in AC classes.

💡 Key Takeaways

- Freight Dominance:₹54,805 Cr growth underscores freight’s role as a revenue pillar.

- Passenger Recovery: Post-COVID rebound highlights restored travel demand.

- AC Coach Efficiency: 30% of coaches generate 47% of passenger revenue.

- COVID Resilience: Freight stabiliSed earnings during pandemic lows.

🚀 Conclusion

The consistent rise in freight and passenger revenue over the past four years highlights the resilience and growth of Indian Railways. Despite the COVID-induced dip, the railway sector rebounded strongly, with both freight and passenger operations contributing significantly. The increased reliance on AC coaches for revenue generation indicates a shift towards premium travel services.

🔍 FAQs

1. What caused the ₹20,024 Cr passenger revenue growth?

Post-COVID recovery, increased AC coach utilisation, and premium fare schemes contributed.

2. How much did COVID-19 impact freight revenue?

Freight dipped slightly in 2020-21 but grew by 24% in 2021-22.

3. Why do AC coaches generate 47% revenue with 18% seats?

Higher ticket prices in AC classes (e.g., 3AC, 2AC) boost per-seat earnings.

4. What role did Tatkal play in revenue growth?

Flexi Fare, Tatkal, and Premium Tatkal schemes contributed 5.7% of passenger revenue.

5. How many coaches does Indian Railways currently operate?

As of April 1, 2024, Indian Railways operates around 79,000 coaches, offering approximately 65 lakh seats.